Taking control of money worries

Local people are getting to grips with their personal finances with Crosslight Advice

Lorelei Freeman, Crosslight’s Financial Capability Lead, tells us about the support on offer and some practical steps people can take.

How can people get started with taking control of their finances?

With the current cost-of-living crisis, many people are feeling the pressure like never before. Personal finances can seem confusing, overwhelming and complicated.

Start by putting together your own budget. Begin by figuring out exactly what you do spend, and what income you are getting, and then use that to help decide what changes you could make to either reduce your spending or bring in more money. Both of these are easier said than done, of course!

Some other ‘quick wins’ you could try to reduce your outgoings: Check through your subscriptions. Do you actually go to that gym any more? Did you forget to cancel that service after your free trial period expired? Use an online price comparison service like USwitch or MoneySavingExpert to see if you could save money on your phone, internet or insurance payments.

What does Crosslight Advice do?

Crosslight Advice, which received a grant from Hammersmith United Charities in 2022, is a debt advice and money education charity which works to lift people out of poverty and help them to build a better future. We have local branches in Hammersmith, Shepherds Bush and Fulham, and support some of the most marginalised and vulnerable people in society through our work. We provide comprehensive debt and benefit advice, as well as free money education and budget coaching programmes to build financial resilience.

People often tell us they feel stressed, anxious, afraid or embarrassed at the start of their time with us. We work together to address these emotions and aim to equip people with some practical ‘money skills’ to navigate everyday life, as well as helpful ways of thinking about our money.

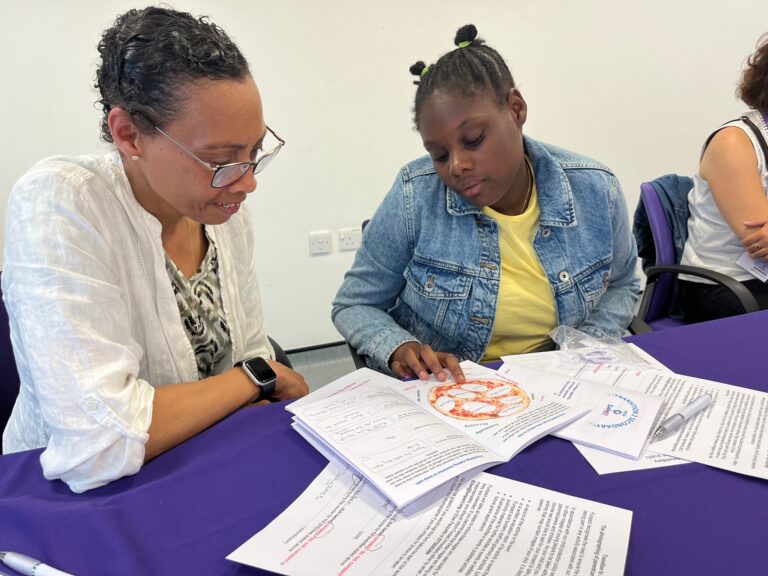

Our free Money course runs twice a month online (daytime and evening). We teach skills to help people understand and manage their money. This helps them gain more control over their finances, and apply tools and ideas to their situation so they can take action in areas where they can make changes.

We also organise regular face-to-face courses in our branches. Our next Hammersmith course will begin on 23 January, running at lunchtime over three weeks, with a meal included. Our St Dionis branch in Fulham will also be running a face-to-face course in the spring.

For one-to-one support, we offer a Budget Coaching programme. We work with people over a series of sessions to look at their money management goals, work out what would be most helpful in achieving them, and plan and take some practical steps together.

Find out more

- Sign up for an online Money course

- Sign up for the next Hammersmith face-to-face course

- Express your interest in the next Fulham face-to-face course – email hello@stdionis.org.uk

- Information about Crosslight Advice

- Information about Hammersmith United Charities’ grant-giving programme. The next application deadline is 12 January 2023.